Your home is your sanctuary, and protecting it is of utmost importance. Lemonade Renters Insurance offers a refreshing approach to safeguarding your belongings and ensuring peace of mind. In this article, we’ll explore what Lemonade Renters Insurance is, why it’s a smart choice, the coverage options it provides, and how it can be your trusted ally in protecting your rented space.

What is Lemonade Renters Insurance?

Lemonade Renters Insurance is a modern and innovative insurance company that specializes in renters’ insurance. What sets Lemonade apart is its use of cutting-edge technology and a commitment to transparency. They’ve reimagined the insurance process to make it simple, affordable, and efficient for renters.

The Importance of Renters Insurance

While your landlord’s insurance may cover the building, it typically doesn’t protect your personal belongings. Renters insurance, like Lemonade, is essential because it provides coverage for your possessions and offers liability protection if someone is injured in your rented space.

Coverage Options

Lemonade Renters Insurance offers a range of coverage options to suit your specific needs:

1. Personal Property Coverage: This covers your personal belongings, including furniture, electronics, clothing, and more, in the event of theft, damage, or loss.

2. Liability Coverage: It provides protection if you’re held responsible for injuries to others or property damage within your rented space.

3. Loss of Use Coverage: If you can’t live in your rental due to a covered event, Lemonade helps cover the costs of temporary living arrangements.

4. Medical Payments to Others: It covers medical expenses if someone is injured in your rental, regardless of fault.

How Lemonade Renters Insurance Works

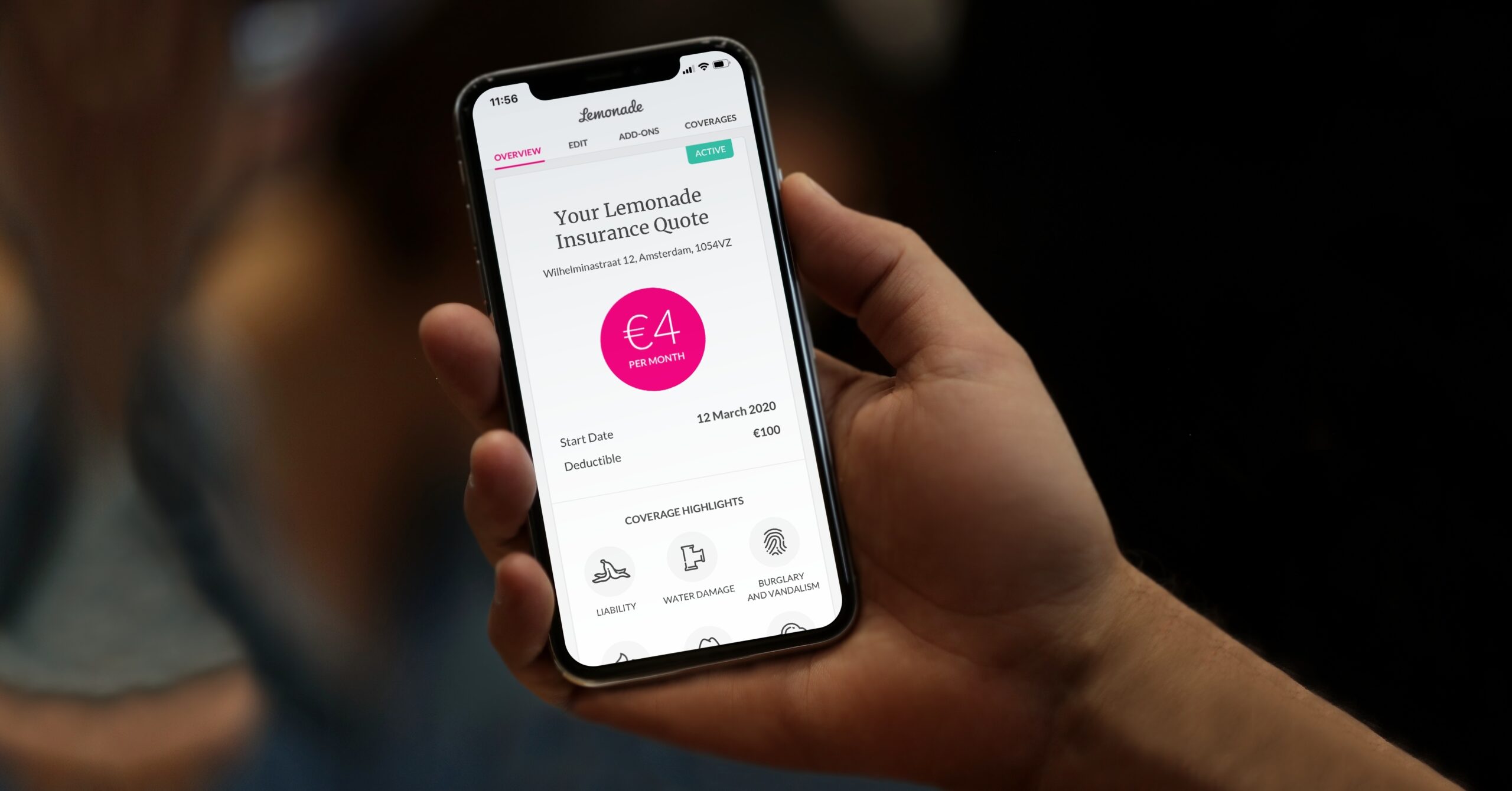

Getting covered with Lemonade is a breeze. You can easily get a quote and sign up for a policy online or through their user-friendly app. They use artificial intelligence and chatbots to streamline the application process, making it quick and hassle-free. In the event of a claim, you can file it through the app, and Lemonade processes many claims instantly.

Benefits of Lemonade Renters Insurance

Opting for Lemonade Renters Insurance offers several advantages:

– Affordability: Lemonade’s efficient online process helps keep costs low, making it an affordable option.

– Transparency: They take a flat fee out of your monthly premium, and any unclaimed money goes to a charity of your choice, enhancing transparency.

– Quick Claims Processing: Many claims are processed instantly, so you receive the support you need when you need it.

Understanding Premiums and Deductibles

Premiums are the regular payments you make to maintain your renters insurance coverage. Deductibles are the amount you pay out of pocket when you file a claim. Lemonade offers flexibility in choosing premium and deductible options that align with your budget.

Why Choose Lemonade Renters Insurance?

Lemonade stands out for its customer-centric approach, innovative use of technology, and commitment to making insurance understandable and accessible. They are changing the way renters think about insurance.

Conclusion

Lemonade Renters Insurance is your partner in protecting your rented home and personal belongings. Whether you’re a first-time renter or someone looking for a fresh approach to insurance, Lemonade offers a solution that ensures you have peace of mind in your rental space.